Time To Be Fearful?

We all know the famous words of Warren Buffett, "The secret to getting rich on Wall Street is to be greedy when others are fearful and fearful when others are greedy." But how can we know others are greedy or fearful?

One way is to look at a Volitility index or otherwise known as the VIX. The VIX is an index that using futures on the S&P 500 to gage the level of volatility that investors expect in the next 30 days.

Let's say you bought a share of stock for $100 and you wanted to buy a put option that will give you the right to sell it at $100 for the next 12 months. That way, if the stock price goes to $50 within the 12 months, you can still sell your share for $100.

How much does that put option cost? $5? $10? 20? It depends on lots of things, but the more fear you have that the price could fall, the more you would be willing to pay for insurance. When all seems fine and stocks are going up, that's when fear is low and the cost of "insurance" becomes low.

The VIX goes up when there is fear and down when there is "less fear" and that makes it a good indicator for when we should be fearful and when we should be greedy.

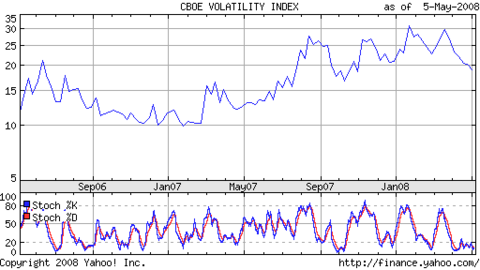

Here is a 2 year chart of this VIX index (click to enlarge images):

On the bottom of this chart is what's called "slow stochastics" which measures overbought and oversold conditions. I will refer to those in a bit.

We can see that the VIX spiked in March of 2007 when the first of the sub-prime credit problems surfaced. Then it spiked again in August and November of 07' and January and March of 08', usually all because of the credit crisis problems that never seem to stop coming.

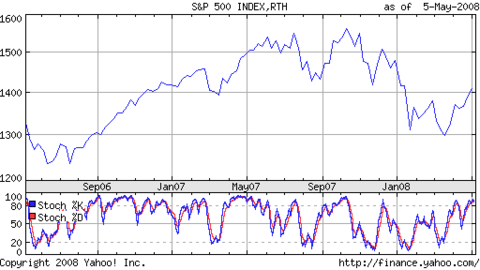

Now let's look at the S&P 500 over the last 2 years:

If we look at the same periods in which the VIX was high (fear and time to be greedy) and when the S&P 500 was oversold (red and blue lines go under 20) it tells the story that when the VIX implies high levels of fear from an expectation of a big fall in the coming 30 days, that's when it's better to be greedy and start buying. Just as when the S&P 500 hit highs, the VIX was down and oversold indicating low fear.

Where are we now? The VIX now looks to be at the lowest it's been since October of last year, the month the S&P 500 was above 1500. It also appears to be oversold judging from the slow stochastics.

The S&P 500, from the slow stochastics appears to be getting overbought.

It is in my opinion, based on the low levels of fear and overbought conditions we're seeing now, that the markets are more likely to reverse to the downside. I'm fearful as it seems investors are being greedy bidding up share prices higher and higher despite deteriorating economic conditions and soaring food and oil prices.

Disclosure: I have no positions in any of the positions mentioned above but may own shares, long or short that are part of the S&P 500 index.

Comments